As we all know, the fintech onboarding industry is growing, but consumers are seeking secure, fast, and seamless financial services. Traditional onboarding processes rely on paperwork, manual verifications, and in-person meetings, which are far from today’s tech-savvy generation.

As Fintech companies face mounting pressure to keep up with industry demands, digital onboarding solutions are quickly becoming an essential part of streamlining operations for financial institutions. Fintech onboarding also helps improve user experience.

Also, I think FinTech companies must adapt to digital onboarding, which will help them grow their business, improve operational efficiency, and stay in a competitive market in today's financial services industry.

Why is Digital Onboarding Important for Fintech in 2025?

In the Fintech onboarding Space, customer trust and satisfaction are very important for financial institutions. In the past, financial services industry companies depended heavily on face-to-face interaction and manual data processing, but this is no longer the case. Digital consumers now expect a seamless experience when interacting with fintech services.

Digital Onboarding not only improves the customer experience but also helps Fintech companies stay updated with financial regulations and reduces operational costs. Fintech onboarding also plays an important role in reducing fraud and improving customer security through advanced Identity verification processes. I mean, there are tons and tons of benefits, but still, there are very few financial institutions adopting digital onboarding.

How Digital Onboarding Works?

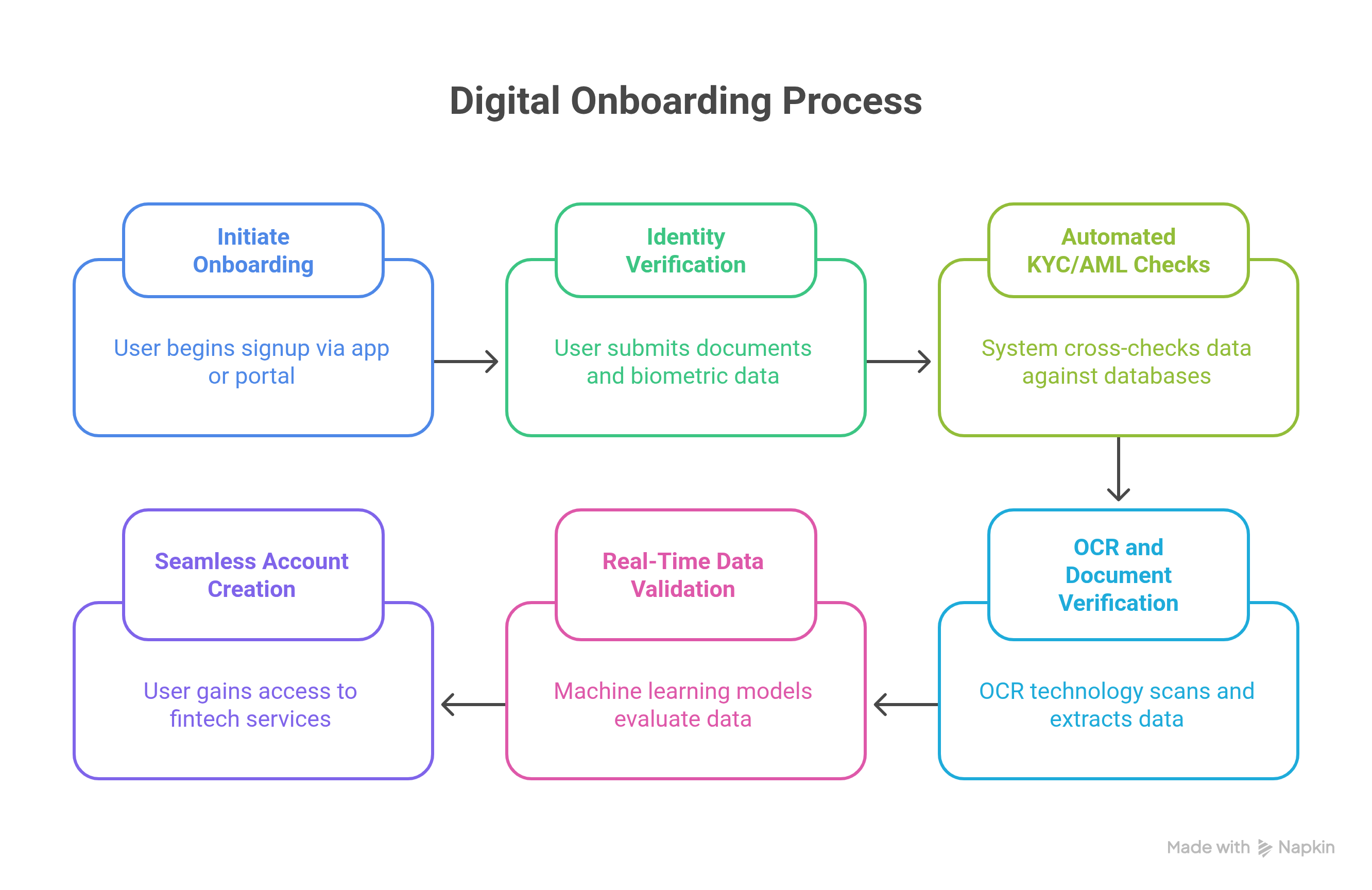

Digital onboarding replaces the traditional manual onboarding process, which we all know is done by automating the key aspects of customer registration, identification verification, and compliance checks. Let's see how the fintech onboarding process works for modern financial institutions.

- Initiating the Onboarding process:- The journey begins when a new user attempts to sign up via a fintech app, website, or self-service portal.

- Identity Verification and Authentication:- This is the important step where users are asked to submit their documents and sometimes biometric data, such as fingerprint. The identity verification process ensures that financial institutions can verify customer identities securely and efficiently.

- Automated KYC and AML Checks:- Once the identity is verified, the system automatically cross-checks the information against the global database for KYC [Know Your Customer] and AML [Anti-Money Laundering] compliance, streamlining the onboarding process for fintech companies.

- OCR and Document Verification:- Optical Character Recognition (OCR) technology scans and extracts data from identification documents such as passports, driver’s licenses, and government-issued IDs, making the fintech onboarding experience faster and more accurate.

- Real-Time Data Validation and Decisioning:- Advanced machine learning models evaluate the user’s application data in real-time, looking for any inconsistencies or signs of suspicious behavior during the fintech onboarding process.

- Seamless Account Creation:- After successfully passing verification and compliance checks, the user is granted access to the fintech services, completing the digital onboarding journey.

So, that is the process of digital onboarding. There are a few companies that are providing APIs for a seamless and faster digital onboarding process, like Chime and Revolut, which help users open bank accounts in under 10 minutes. Crazy!

These platforms use digital onboarding to verify identities via facial recognition, scan documents, and automatically cross-check data against AML and KYC databases. This demonstrates how financial institutions can leverage technology to create efficient fintech onboarding experiences.

Industry Application of Digital Onboarding in FinTech

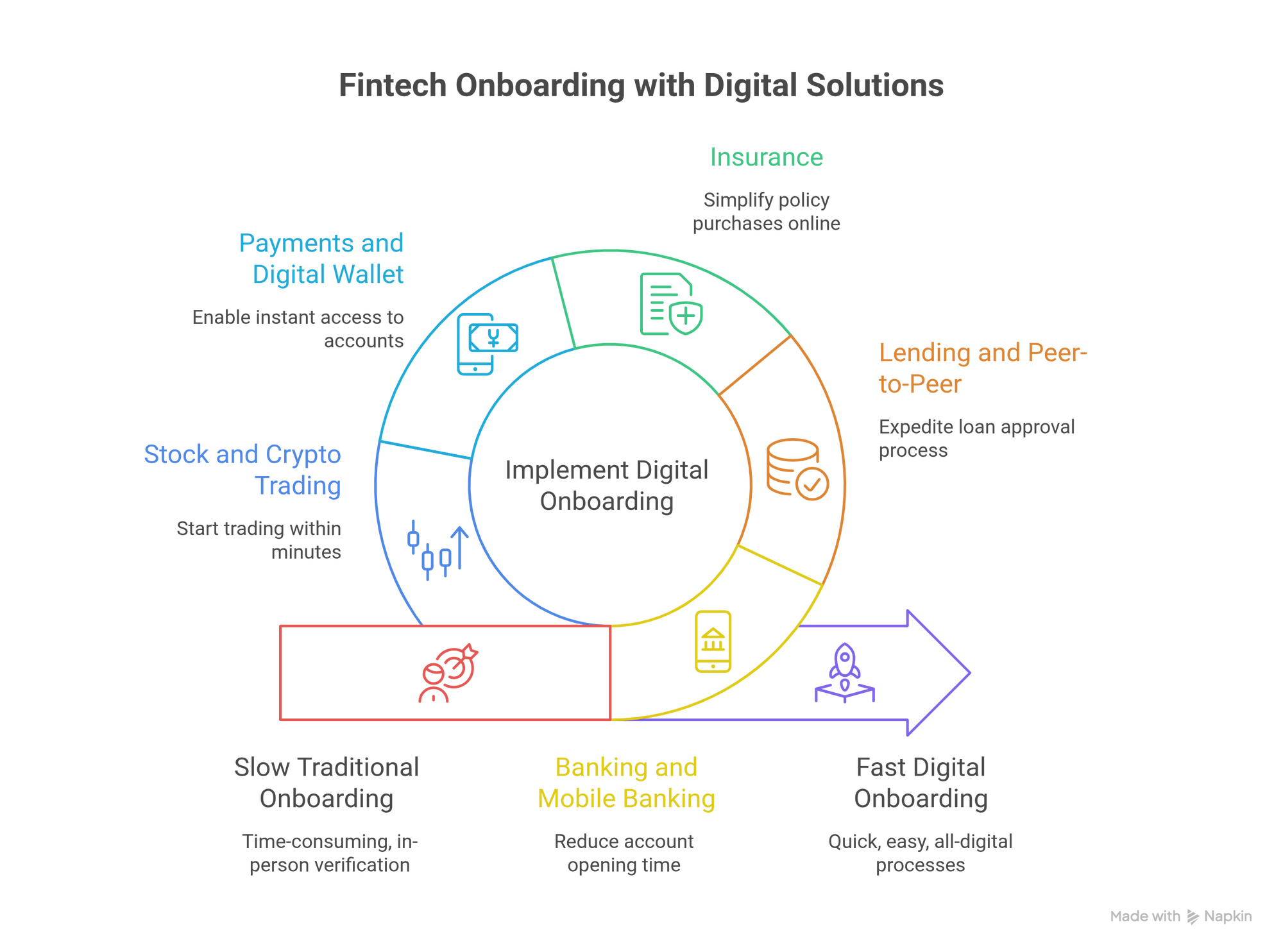

Alright! Now that we have the basics out of the way, let's look at a few financial institutions that are implementing fintech onboarding across different sectors. I mean, there might be more applications than what we are mentioning here. This financial services industry sector will see major improvements through digital onboarding.

- Banking and Mobile Banking

Traditional financial institutions have long relied on in-person branch visits for identity verification [In a few cases], but this is changing. Digital banks like N26 and Monzo are leading the way by using digital onboarding to reduce the time it takes to open an account, which is from several days to minutes through their fintech applications.Here is one more Fun Fact:- 79% of customers want financial institutions to give them more all-digital processes in the onboarding process. Make it easy to handle processes with less time through fintech apps. - Lending and Peer-to-Peer Lending

Digital onboarding has made it easier for online lenders like Upstart and LendingClub to quickly assess loan applications and verify borrower identities through streamlined fintech onboarding processes. Automated systems can analyze credit scores, bank statements, and other financial records in real-time, expediting loan approval and disbursement for fintech companies. - Insurance

Financial institutions in the insurance sector are adopting digital onboarding to simplify policy purchases and claims processing. InsurTech startups like Lemonade have made the onboarding process entirely digital, allowing users to verify their identity and sign policy agreements without paperwork through their fintech app. - Payments and Digital Wallet

Digital payment platforms like PayPal and Venmo use biometric authentication and digital document verification to securely onboard fintech users, enabling instant access to accounts and payments through their fintech applications. Here is another Fun Fact:- Mobile wallets are the most popular payment method for about half of all transactions, and it's expected to reach 61% by 2027. This growth is driving more financial institutions to enhance their fintech onboarding capabilities. - Stock and Cryptocurrency Trading Platforms

Trading platforms like Robinhood and Coinbase have incorporated digital onboarding to allow users to open accounts, verify their identity through advanced identity verification processes, and start trading within minutes using their fintech apps.

Ready to Grow Your Fintech Onboarding Process?

Build innovative solutions with our expert team. Let's innovate together!

Why Fintech Needs Digital Onboarding in 2025

Now, let's get to the point - the financial services industry is changing rapidly, and fintech companies need efficient, secure, and regulatory-compliant onboarding processes.

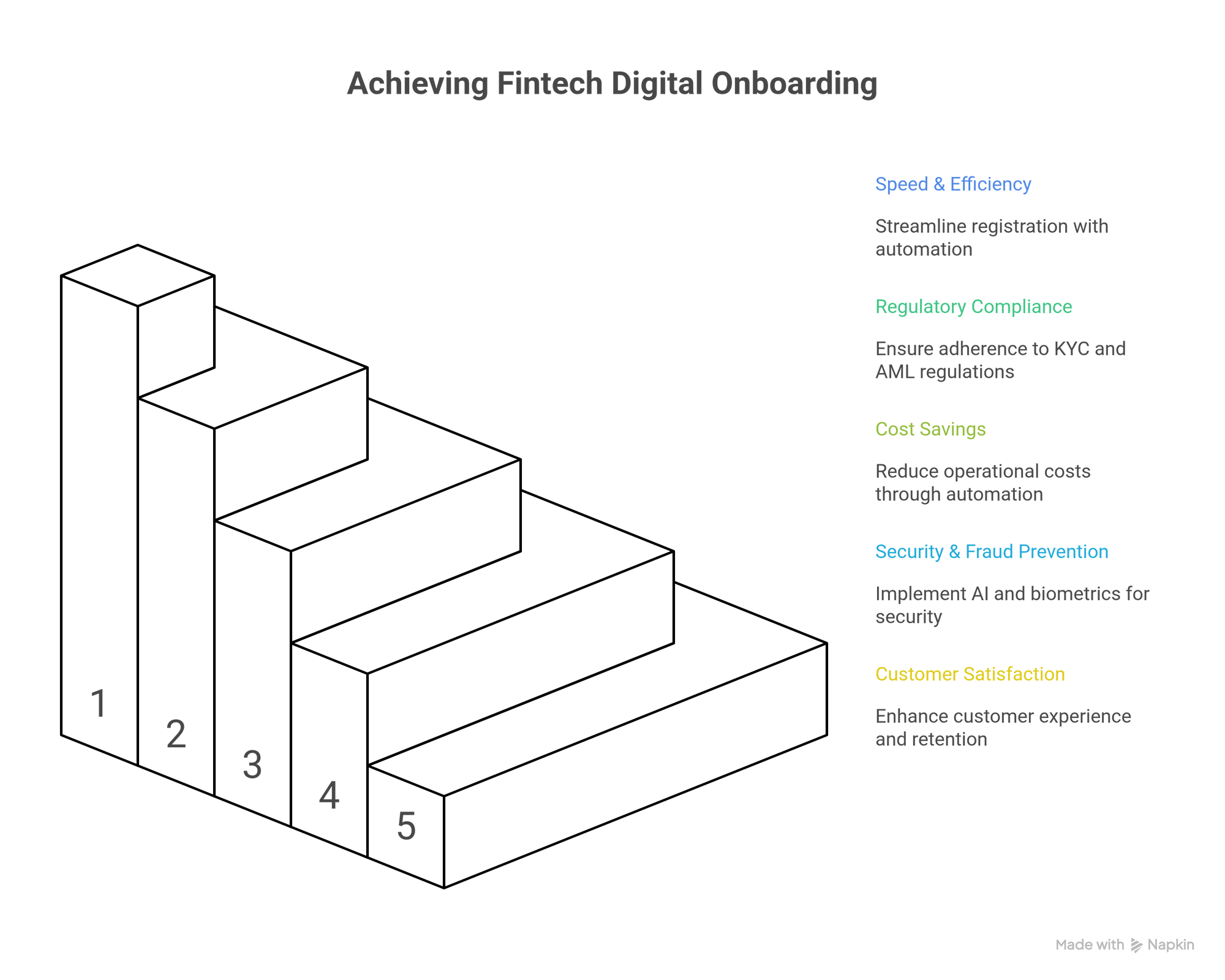

Here are some of the core benefits driving financial institutions towards digital onboarding.

- Speed and Efficiency

Digital onboarding speeds up the registration process by eliminating paperwork and automating document verification, significantly reducing customer wait times for fintech applications.

Fun-Fact:- Platforms using digital onboarding experience 40% faster onboarding than those relying on traditional methods.

- Regulatory Compliance

With constantly changing regulations around KYC and AML, Fintech companies must make sure they remain compliant with them. Automated compliance checks in digital onboarding streamline the process of adhering to local and international regulatory requirements.

Example: Plaid, a leader in financial data integration, uses fintech digital onboarding to ensure its clients, financial institutions, stay compliant with AML and KYC regulations globally through automated identity verification processes.

- Cost Savings

Reducing the need for manual data entry, paper handling, and in-person meetings can drastically cut operational costs fintech companies. Additionally, fewer errors in the onboarding process lead to fewer chargebacks, fraud claims, and compliance issues for financial institutions.

Facts:- Financial institutions are adopting digital onboarding and paperless processes for recruitment, background verification, and e-signature of contracts, leading to a 60% reduction in fintech onboarding time.

- Security and Fraud Prevention

Digital onboarding solutions use advanced AI and biometric authentication through fintech apps to ensure that only legitimate users gain access to services, minimizing the risk of identity theft and fraud. Modern identity verification systems make sure financial institutions can trust their customer data. - Customer Satisfaction and Retention

A smooth, fast onboarding process builds trust with customers, improving customer satisfaction and driving higher retention rates for fintech applications. Customers who experience frictionless fintech onboarding are more likely to return and engage with the fintech app in the long term.

Regulatory Compliance and Security in Digital Onboarding

Regulatory compliance and security are fundamental pillars of successful fintech onboarding. Financial institutions must navigate an increasingly complex regulatory environment while maintaining robust security measures that protect customer data and prevent financial crimes.

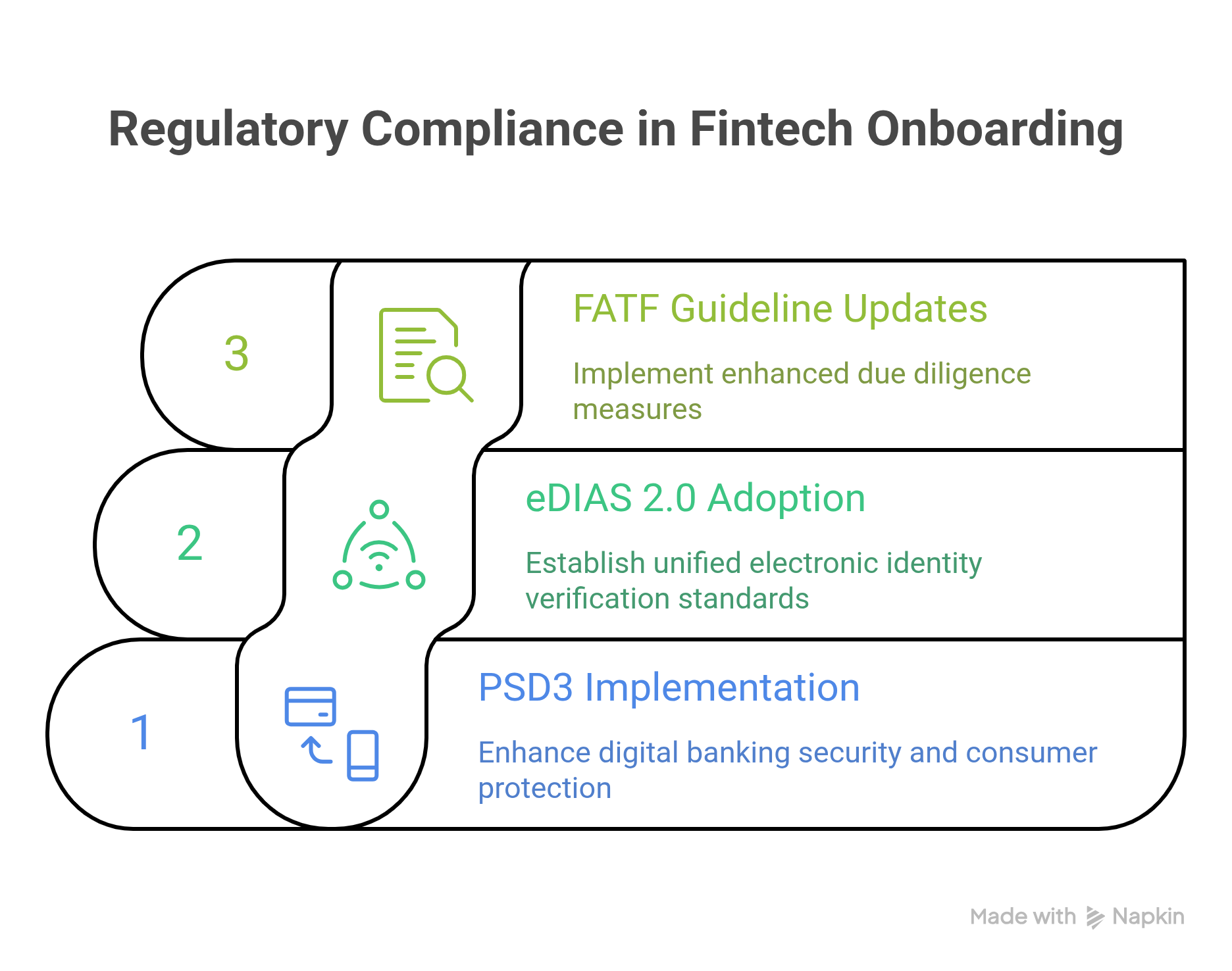

2025 Regulatory Updates and Requirements

The regulatory environment for digital onboarding continues to evolve rapidly. Fintech companies must stay current with key regulatory developments.

PSD3 (Payment Services Directive 3): Expected implementation in 2026, this updated directive will enhance digital banking security requirements and improve consumer protection during fintech onboarding.

eDIAS 2.0 (Electronic Identification, Authentication and Trust Services): This regulation establishes standards for electronic identity verification across EU member states, creating unified onboarding processes for financial institutions.

FATF Recommendation Update:- The Financial Action Task Force continues updating guidelines for identity verification processes, requiring fintech apps to implement enhanced due diligence measures.

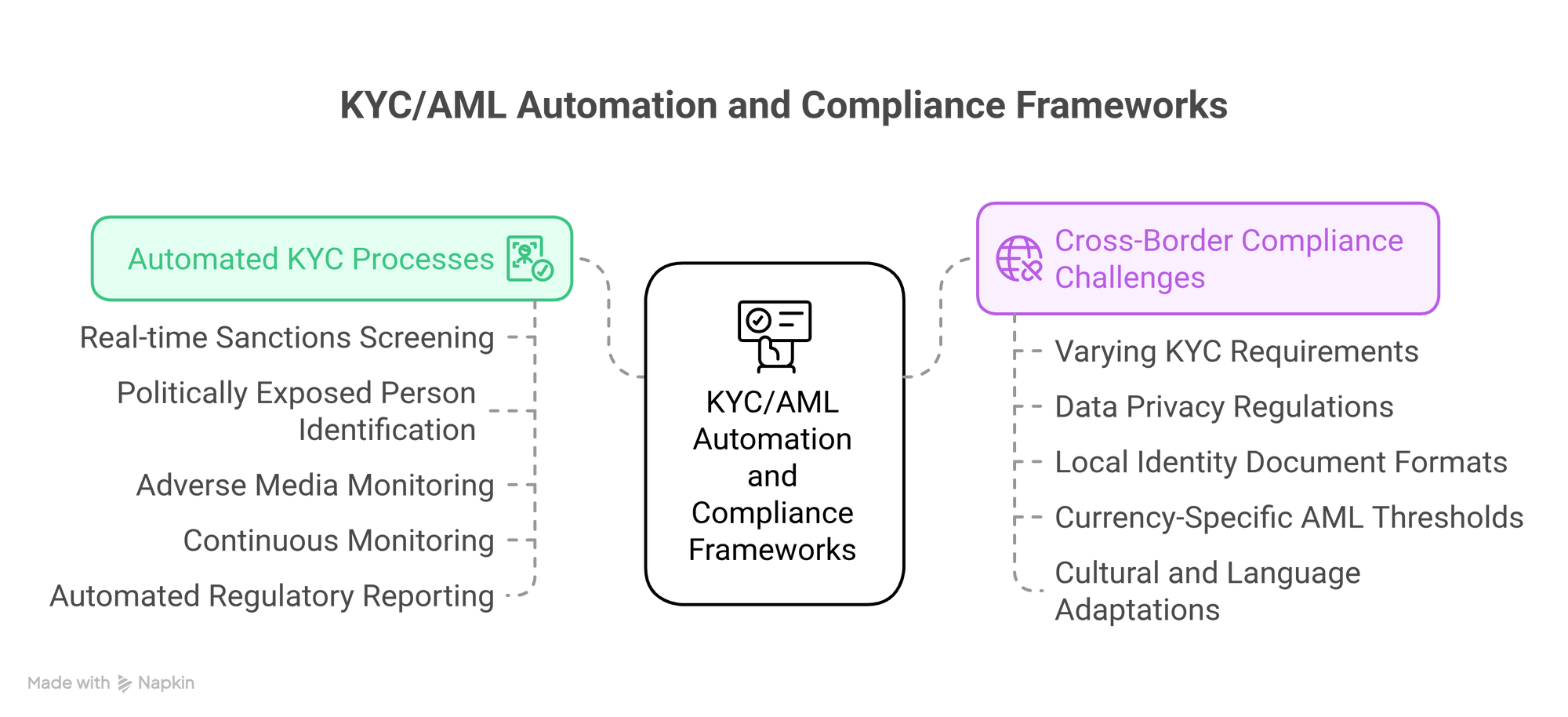

KYC/AML Automation and Compliance Frameworks

Modern fintech onboarding platforms integrate automated compliance checks that ensure financial institutions meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements efficiently.

Automated KYC Processes include

- Real-time sanctions screening against global watchlists.

- Politically Expose Person identification.

- Advers media monitoring and risk scoring.

- Continuous monitoring throughout the customer lifecycle.

- Automated regulatory reporting and audit trails.

Financial institutions using automated compliance systems reduce manual review time by 70% while maintaining 99.8% accuracy in regulatory adherence.

Cross-Border Compliance Challenges

Fintech companies operating globally face complex compliance requirements across different jurisdictions. Digital onboarding platforms must accommodate.

- Varying KYC requirements across countries and territories.

- Different data privacy regulations (GDPR, CCPA, LGPD).

- Local Identity document formats and verification standards.

- Currency-specific AML thresholds and reporting requirements.

- Cultural and language adaptations for onboarding processes.

Enhanced Security Measures for Financial Institutions

Fintech onboarding security goes beyond basic encryption. Modern financial institutions implement multi-layered security approaches.

- Zero-Trust Architecture: Every user and device is verified continuously throughout the onboarding process, regardless of location or preview authentication.

- End-to-End Encryption: All data transmitted during fintech onboarding is encrypted using advanced cryptographic protocols, ensuring customer information remains secure.

- Fraud Prevention Networks: Fintech apps share anonymized fraud intelligence to identify and prevent sophisticated attack patterns across the financial services industry.

- Quantum-Safe Encryption: Forward-thinking financial institutions are implementing quantum-resistant encryption to future-proof their digital onboarding security.

Data Privacy and Customer Consent Management

Fintech companies must balance comprehensive identity verification with strict data privacy requirements. Modern fintech applications are implemented.

- Granular consent management allows customers to control data usage.

- Data minimization practices collect only necessary information.

- Right to be forgotten compliance for GDPR and similar regulations.

- Transparent privacy policies explaining data handling during fintech onboarding.

Best Practices for Optimizing Digital Onboarding in FinTech

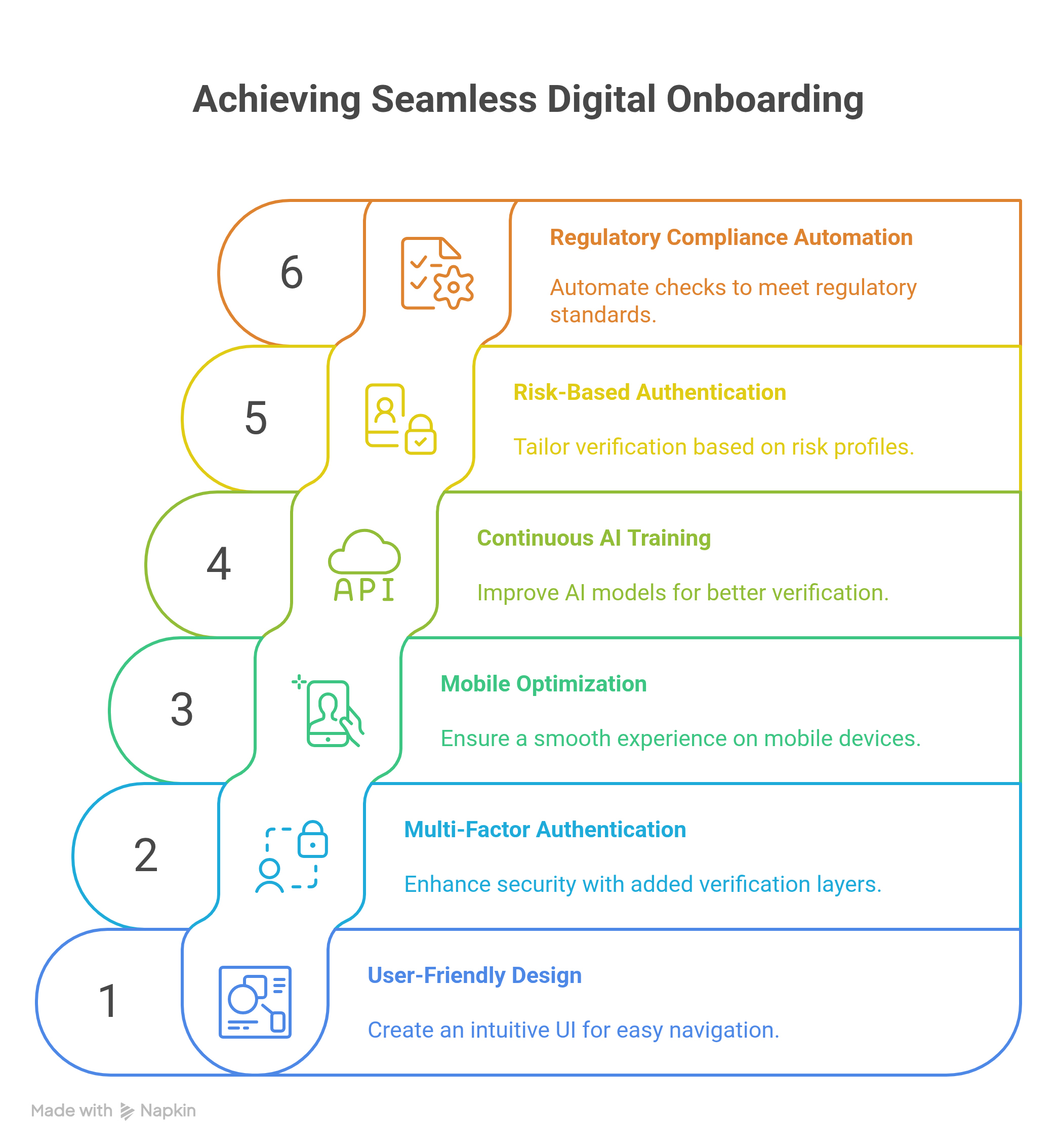

To make the most of digital onboarding, Fintech companies should follow best practices for improving user experience, security, and regulatory compliance. These strategies help financial institutions create seamless fintech onboarding experiences.

To make the most of digital onboarding, Fintech companies should follow best practices for improving user experience, security, and regulatory compliance. These strategies help financial institutions create seamless fintech onboarding experiences.

- User-Friendly Design

A clean, simple, and intuitive user interface (UI) makes sure that users can navigate the onboarding process without confusion or frustration. Modern fintech apps prioritize design simplicity to reduce drop-off rates during fintech onboarding. - Multi-Factor Authentication (MFA)

Implement multi-factor authentication (e.g., email verification, SMS codes, biometrics) to provide an added layer of security during the fintech onboarding process. This approach helps financial institutions maintain robust identity verification standards. - Mobile Optimization

Make sure that the digital onboarding experience is optimized for mobile users, as many customers interact with the financial services industry via their smartphones. Mobile-first fintech applications see significantly higher completion rates. - Continuous AI Training

Continuously train AI models to improve the accuracy and efficiency of identity verification, fraud detection, and risk assessments. Advanced machine learning helps fintech companies adapt to evolving fraud patterns in real-time. - Risk-Based Authentication

Implement dynamic verification processes that adjust based on customer risk profiles. Low-risk users experience streamlined fintech onboarding while higher-risk customers undergo enhanced identity verification processes. - Regulatory Compliance Automation

Automate compliance checks to ensure adherence to KYC, AML, and other regulatory requirements across different jurisdictions. This helps financial institutions maintain consistent compliance standards.

Top Fintech APIs for Finance Software in 2025

Explore the most powerful fintech APIs driving innovation in banking, payments, and financial services. Get expert insights on integration strategies, pricing models, and how to choose the right APIs for your finance software development.

Read more

Top 10 Reasons Why Fintech Digital Onboarding in 2025

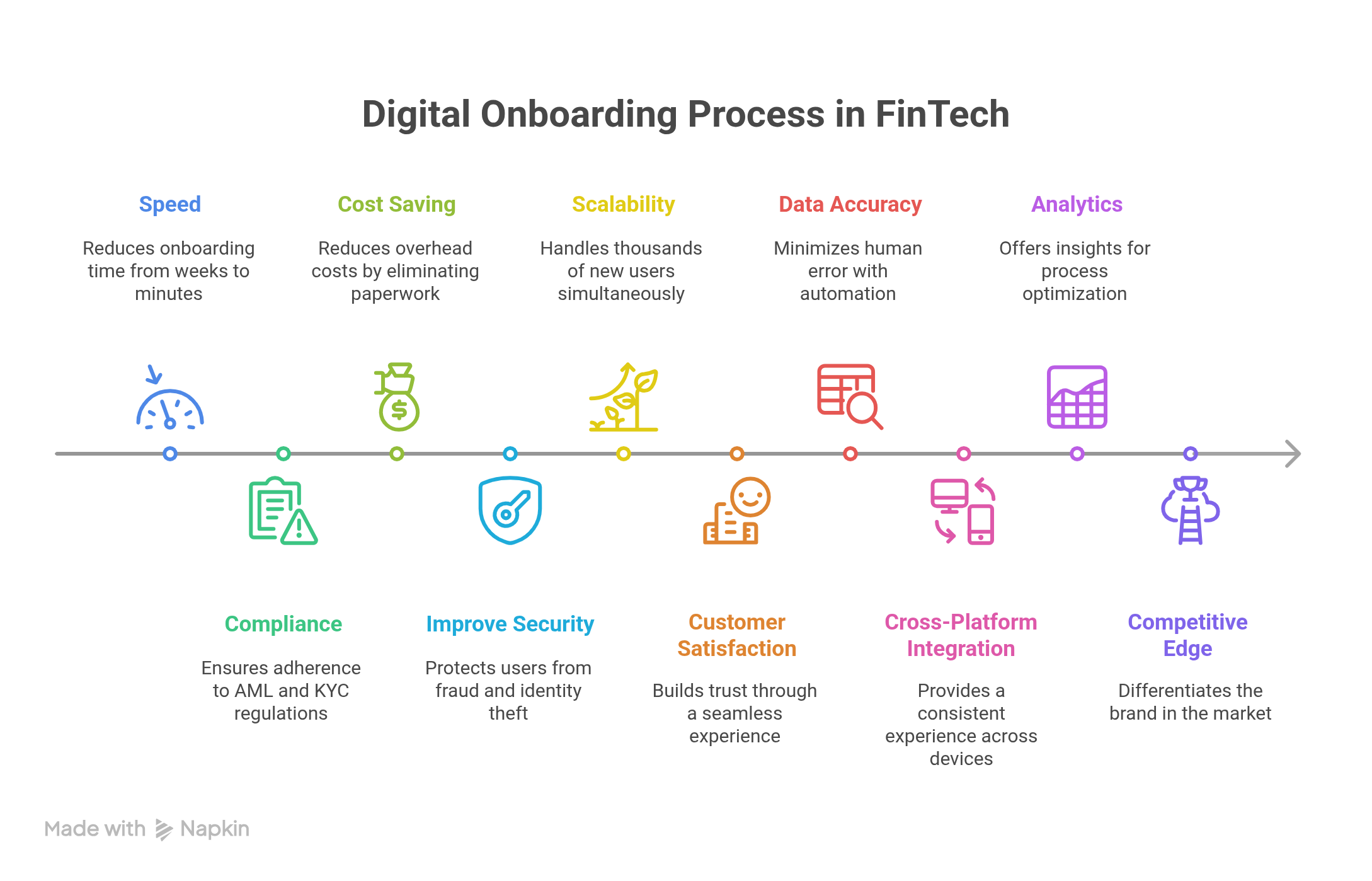

Now, let's focus on the part we are waiting for. Here are the top 10 reasons why Fintech companies should adopt digital onboarding to streamline their processes, improve customer experience, and ensure compliance with regulations.

- Speed:- Digital Onboarding reduces onboarding time from weeks to minutes

One of the most significant advantages of digital onboarding is the drastic reduction in onboarding time. Traditional onboarding processes often involve filling out paperwork, conducting in-person meetings, and waiting for the manual verification step, which can take weeks. In contrast, digital onboarding accelerates this entire process to just a few minutes.This speed boosts conversion rates, as customers are more likely to complete the fintech onboarding process when it’s quick and easy. Financial institutions like Revolut and Chime have reduced the digital onboarding time to just minutes through their fintech apps. - Compliance:- Make sure there is adherence to AML, KYC, and other regulatory requirements.

Digital onboarding platforms are designed to automatically integrate with global databases and regulatory frameworks, ensuring that fintech companies comply with Anti-Money Laundering (AML), Know Your Customer (KYC), and other important financial regulations.Automated compliance checks streamline identity verification processes and help financial institutions avoid regulatory penalties while maintaining consistent standards across all customer interactions. - Cost Saving:- Reducing overhead costs

By replacing traditional methods such as paper forms, in-person verifications, and manual data entry, fintech onboarding can significantly cut operating costs for financial institutions. There's no need for physical infrastructure like branches or additional personnel to handle paperwork.These cost savings can be reinvested in improving other areas of the business. Fintech companies like Upstart, a digital lender, have reduced costs related to manual verification and handling by adopting digital onboarding with AI-driven systems. - Improve Security:- Protecting users from fraud and identity theft

Digital onboarding leverages biometrics, AI algorithms, and advanced encryption to secure the onboarding process and protect sensitive information from cyber threats. Facial recognition, fingerprint scanning, and two-factor authentication (2FA) add layers of security to verify user identity.This makes it much harder for fraudsters to impersonate legitimate customers, reducing the risk of identity theft or financial fraud. For example, PayPal uses biometric authentication and multi-layer security protocols. - Scalability: Handling thousands of new users simultaneously

As Fintech companies grow and acquire new customers, scalability becomes a key consideration. Digital onboarding is designed to handle large volumes of users simultaneously without compromising speed or accuracy.This enables Fintech companies to expand quickly while maintaining a seamless customer experience. For example, Robinhood, a leading stock trading app, processes millions of signups each month with the help of its scalable fintech onboarding system. - Customer Satisfaction: A seamless onboarding experience builds trust

A seamless and user-friendly digital onboarding experience is important for creating a positive first impression. Hassle-free registration, minimal data entry, and quick approvals foster trust with customers, making them more likely to stay engaged with the fintech applications.Higher customer satisfaction leads to increased retention rates and improved customer lifetime value. Lemonade, an InsurTech platform, offers a 10-minute insurance signup process through its innovative fintech app. - Data Accuracy:- Minimizing human error with automation

Manual data entry is prone to mistakes, which can lead to delays and increased fraud risks. Automated data validation via AI and OCR technology makes sure that customer information is correct, reducing the likelihood of errors. This improves accuracy and compliance with regulations. This also reduces the costs associated with correcting mistakes. One good example is Stripe, a payment company that uses automated tools to verify bank account details and addresses, minimizing the risk of incorrect or fraudulent information entering the system. - Cross-Platform Integration:- Consistent experience across devices

Digital onboarding solutions are built to be platform-agnostic, meaning they can be seamlessly integrated across mobile, web, and desktop platforms. This consistency ensures that users can complete their onboarding process on any device.Cross-platform solutions are very important today, as they ensure users have a uniform experience from any device and operating system. This increases customer satisfaction and engagement with fintech applications. - Analytics:- Valuable insights for process optimization

Digital onboarding platforms provide real-time analytics that track every step of the onboarding process. Fintech companies can monitor user behavior, identify bottlenecks, and make data-driven improvements to enhance the experience.By analyzing drop-off points, conversion rates, and user engagement, financial institutions can fine-tune their fintech onboarding for maximum efficiency.Kabbage, an online lender, uses onboarding analytics to optimize loan application forms, improving the overall experience and ensuring a smooth application process. - Competitive Edge:- Differentiating your brand in a crowded market

Adopting digital onboarding can set your brand apart from the competition. By offering a superior onboarding process, fintech companies can attract and retain more customers in the competitive financial services industry.Adopting digital onboarding technologies shows that your company is forward-thinking, reliable, and committed to providing the best customer experience.Just like N26, it's the first 100% mobile bank to be granted and operate with a full German banking license from the German Federal Financial Supervisory Authority.

Let's Build Your Advanced Digital Onboarding Solution

Book a free consultation and discover how we can cut your development costs by 40% while accelerating time-to-market.

Conclusion

That’s everything! I think it's very important for fintech companies looking to stay competitive and meet the changing demands of modern consumers. With the right tools and strategies in place, financial institutions can not only improve security and compliance but also deliver a seamless, user-friendly experience that fosters trust and increases customer satisfaction.

One more thing! If you are looking to adopt digital onboarding into your applications or are looking to build custom software solutions, we can help you build software that will be custom-made for your needs. We are an official FlutterFlow partner, and with a decade of experience in Fintech software development, we will help you grow your business. Contact us today!

One more thing! If you are looking to adopt digital onboarding into your applications or are looking to build custom software solutions, we can help you build software that will be custom-made for your needs. We are an official FlutterFlow partner, and with a decade of experience in Fintech software development, we will help you grow your business. Contact us today!

FAQs

What is digital onboarding?

Digital onboarding is an online process that allows customers to complete registration and identity verification via technology, removing manual paperwork and in-person interactions. Fintech companies use automated systems to streamline the onboarding process for faster, more secure customer acquisition.

How secure is digital onboarding?

Digital onboarding uses encryption, biometric authentication, and AI-driven fraud prevention to ensure the highest levels of security. Modern fintech apps implement multi-layer security protocols including identity verification processes, liveness detection, and real-time fraud monitoring to protect customer data.

What regulations do digital onboarding platforms follow?

Fintech onboarding platforms comply with KYC, AML, and other regulations to ensure the onboarding process adheres to legal requirements. Financial institutions benefit from automated compliance checks that maintain regulatory standards across different jurisdictions.

How does digital onboarding reduce fraud?

By using advanced AI and biometric technology to authenticate identities and screen for fraudulent activity, fintech onboarding significantly reduces fraud risks. Fintech apps employ behavioral biometrics, document verification, and real-time risk assessment to prevent fraud during the onboarding process.