Blockchain technologies were first explained by the research scientists Stuart Haber and W. Scott Stornetta in 1991. While it existed since then, it’s in the last few years that blockchain technologies came into the spotlight across the continents.

Blockchain technology mainly originated with the requirement for time-stamping digital documents to prevent them from getting tampered or backdated. However, with time it evolved to become a more widely-adopted solution in this digital world. Not only has it emerged as a whole new sector but it also holds high market potential that is worth investing in. The global blockchain was worth $1.57 billion in 2018 and is forecast to grow to $163 billion by 2027 which is 100 times more compared to its 2018 benchmark. But, what’s the deal? Why are blockchain technologies so popular? Or, to start with, what is blockchain technology? Many people don’t have a clear idea of what a blockchain is. So, in this blog, we will give you an in-depth overview of what blockchain technology is and how it works.

What is Blockchain?

Blockchain is one of the most talked-about subjects practically everywhere. Many key advances and changes in financial technologies, such as blockchain, have been noticed since the beginning of the twenty-first century. It is critical to understand what it really signifies and represents in today's global economy.

The primary technological enablers of recent breakthroughs in distributed transaction and ledger systems are blockchain technology and distributed database technologies. These technologies result in the opening of new doors for open source prospects, particularly new sorts of digital platforms and services. We can describe open source as any programme whose source code is made publicly available, and open source software is typically produced as a collaborative effort and distributed for free.

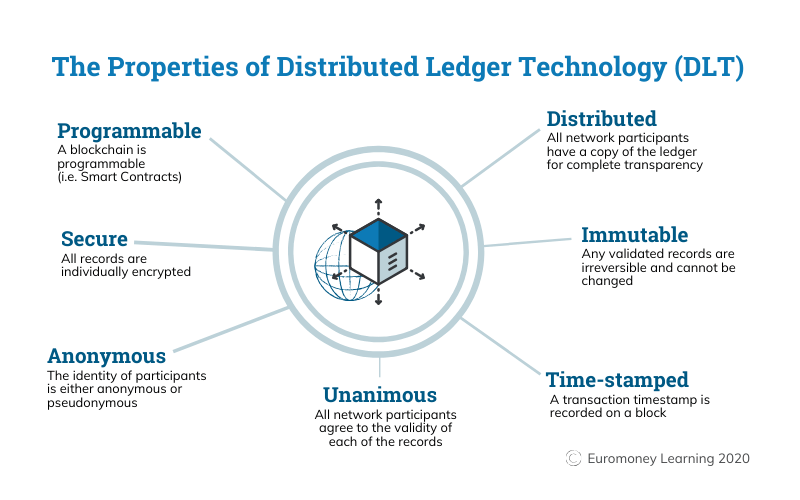

The most significant blockchain applications would necessitate close collaboration among developers, incumbents, innovators, and regulators, which will add complexity and postpone adoption. The term "blockchain environment" refers to a completely distributed system for cryptographically collecting and preserving an immutable, consistent, and linear transaction log between networked participants. It's akin to a distributed ledger, which is kept, updated, but not deleted, and validated by all parties involved in a network's transactions. Blockchain technology is currently attracting a lot of attention from academics and the general public. Its goal is to lay the groundwork for completely trustworthy economic transactions.

In most cases, blockchain systems can not only conduct monetary transactions, but also ensure that they follow programmable rules in the form of "smart contracts." The blockchain, the distributed ledger that underpins the well-known cryptocurrency Bitcoin, has far-reaching ramifications for a wide range of sectors. The introduction of Bitcoin and the blockchain has ushered in a sea change in the financial sector. It is also a type of financial instrument that has the potential to play a significant role in the global economy's long-term development. Blockchain technology has the potential to change the way businesses are conducted. It has an impact on a variety of industries, including finance, manufacturing, and education.

Also Read: How to Create an NFT Marketplace?

What is Blockchain Technology? All You Need to Know

Much of the thought leadership on blockchains in financial services has been concentrated on Western Europe and the United States, whereas Asia has received less attention. This is odd because in the United States, trust is strong and uniform across state lines, whereas in Europe, the market is more closely aligned by regulation.

However, Asia continues to lag behind in terms of confidence, which is necessary for increased economic activity. Asia's geopolitical setting is unique in the world: the region is made up of loosely tied countries that desire to trade with one another, but their levels of trust differ, preventing the region from realizing its full potential. We believe that blockchains that can work across geopolitical boundaries will be the most transformational.

Because blockchain technologies and the space are new, there are a variety of ways to comprehend blockchain systems, and terminology has yet to be established. A blockchain, in its most basic form, is a shared, replicated, append-only database with write access shared among participants but validation conducted by all.

There are several elements that are common to most blockchain systems:

- A data repository that often holds financial transactions but might hold any type of information

- Real-time data replication across many systems

- Instead of hierarchical client-server architectures, peer-to-peer network topology is used

- To authenticate identity, authenticity, and enforce read/write access permissions, encryption and digital signatures are used

- Mechanisms that make it difficult to alter historical records while also making it easy to discover attempts to do so

The difference between public and private blockchains in terms of setup and functionality is whether they are public or private; like any network that is available to the public, public blockchains require different defenses than private blockchains. Depending on whether they require everyone to be able to write to them (public or permissionless blockchains) or if the participant pool is limited, different procedures or protocols are used (private or permissioned blockchains). The system's engineering is influenced by the blockchain's goal. Public-write blockchains are, on average, substantially more limited than private blockchains.

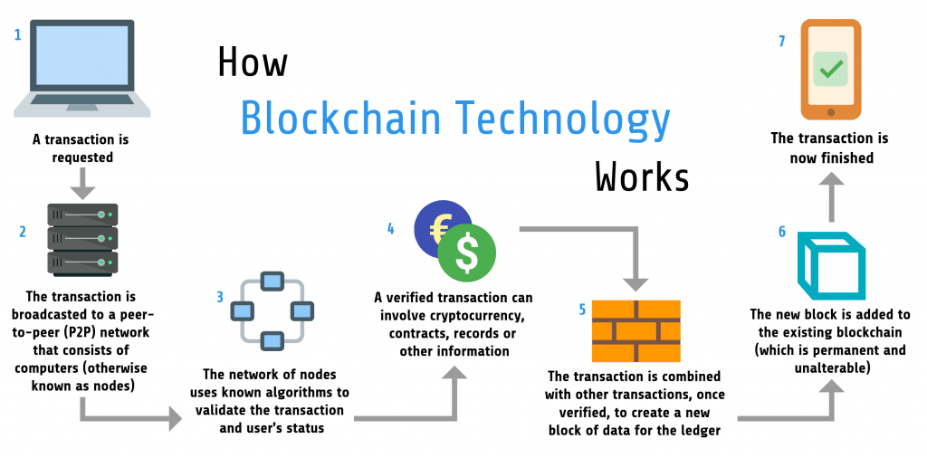

To be a part of a blockchain system, each participant must install and run software that connects their computer or server to the network's other participants. Participants function as individual validators, or network nodes, by running this programme. The database, commonly known as the blockchain, is managed by a network of nodes. The nodes serve as entry points for new data, as well as validation and propagation of newly submitted data to the blockchain.

But how can the network reach consensus, or agree on what data to publish on the blockchain, in a distributed system with no single source of truth? How do you deal with a situation where two people who are equal can assert contradictory things but there is no one to arbitrate? The solution is to use protocols. There will be protocol in a blockchain system, which consists of pre-agreed criteria for technical and business validity of data to be written, as well as a rule to decide how consensus is achieved.

Similar transactions are grouped together to form a block. The name blockchain comes from the fact that these blocks are added in a chronological manner, resembling a chain. These new blocks are then stored on the nodes' local blockchain database on their PC or server.

Also Read: How to Create Music App Like Spotify?

Different Types of Blockchain Explained

There are different types of blockchains that work slightly differently from one another. Let’s have a look -

Bitcoin

The Bitcoin Blockchain was the first publicly known and debated blockchain, and it serves as the de-facto example of how blockchain systems can function. The Bitcoin Blockchain is a database file that resides on thousands of computers around the world, with individual copies kept in sync by the Bitcoin protocol's rules. The Bitcoin Blockchain file (really, it's a sequence of files because huge files are difficult to maintain) contains a list of every single bitcoin transaction that has ever taken place: it's the Bitcoin ledger of record, and it's been growing since January 2009.

The Bitcoin Blockchain is a permissionless or open database.That is, if you want to make changes to the database, you can do so without having to sign up, log in, or ask someone in authority for permission. In reality, this is accomplished by downloading and executing open source software. Your computer will connect to other computers running comparable software through the Internet as a result of this. By playing a computationally difficult lottery known as mining, the software allows you to start transmitting and receiving bitcoin transaction data with your neighbors, as well as adding data to the bitcoin blockchain. It is simple to see which bitcoin accounts have how many bitcoins and which accounts are sending bitcoins to whom by reviewing the Bitcoin Blockchain file.

This transparency is required so that transaction validators can decide whether or not a transaction is authentic. A Bitcoin transaction that pays someone with bitcoins that don't exist, for example, would be invalid.

Ripple

Ripple stands in the middle of the public and private systems, relying heavily on Ripple Inc.-controlled validating nodes. Customers would park real-world assets with 'Ripple Gateways,' who would create tokens against the assets, much to how goldsmiths issued receipts against gold deposits, in order to dematerialize currencies and assets. The tokens can be sent between Ripple accounts, swapped for other tokens, and finally redeemed by returning them to the guardian in exchange for the real-world object.

NXT

NXT is a public platform that began in November 2013 with the creation of its genesis block. Instead of bitcoin's energy-intensive 'proof-of-work,' it uses a slightly different block-adding technique called 'proof-of-stake.' 'Proof-of-stake' distributes mining rewards in proportion to the balance of your account, rather than the amount of electric power you use. More than just passing tokens around is possible with the NXT platform (to date it has messaging, new token creation, new asset creation, a decentralized exchange, and a marketplace).

Ethereum

Ethereum is a public platform that takes distributed computing to the next level. Instead of acting as a huge consensus database, the Ethereum network functions as a single giant consensus computing engine. Its computations are 'Turing-complete,' which means it can calculate anything that any other computer can, but at a far slower rate. The genesis block of Ethereum was released in July 2015, and the network is now one of the most popular platforms for permissionless smart contracts.

Advantages of Blockchain Technologies

The transparency given by blockchain could aid in circumstances where trust levels are low due to variations in operational and regulatory settings, such as multi-party cross-border transactions, by making the lack of trust less of a barrier in these interactions.

Efficiency

When it comes to reconciling trades, blockchain technology has the potential to increase efficiency. A bank will usually designate one of its systems as the primary source of trade data for any given security. An in-house built system or an off-the-shelf solution could be that golden source. Due to system incompatibilities and processes, reconciling this against an external party (whether it's the trade counterpart or an industrial third party) causes delays and inefficiencies. As a result, reconciliation is done using the "best common technology" – usually batch reconciliation at the end of the day.

The negotiated trade data will be in-house using a blockchain, eliminating the need to reconcile outside because the blockchain has already done so in real time. The adoption of blockchains may also aid in the acceleration of payments between financial institutions. Because blockchains can hold data, they may also include code snippets that use "if-this-then-that" logic to automate messaging and one-day payments. If parties can agree on payoffs in advance (typically in term sheets written in dry legalese) and can encode the payment terms into the trade details itself, there can be efficiencies during trade lifecycle events, such as reduced errors and increased speed. Smart contracts are code snippets that are saved on blockchains.

Also Read: Top 10 Product Development Frameworks for Startups

Transparency

Regulators and other interested parties can connect into trade data provided to a shared platform to gain a real-time perspective of deals. Rather than receiving reports in multiple formats at different times from each institution, regulators now have access to a single source of information. Blockchains' transparency could aid authorities in detecting systemic hazards sooner. Traditionally, companies had to rely on extensive legal documents, such as master agreements with the International Swaps and Derivatives Association (ISDA). However, by definition, computer code is significantly more readable and predictable than legal language.

A smart contract on a blockchain gives considerably better degrees of transparency over outcomes by placing payment structures onto a shared platform in computer code that can be checked against.

Non-financial parties may also benefit from blockchain applications' openness because they allow various parties to have access to the same data, whereas data kept by third parties is often obscured or suppressed.

Resilience

Data is more resilient when it is stored over a wide number of nodes - the higher the number of blockchain participants, the more robust the data is, with a longer life. A blockchain system is akin to a massively replicated database in this regard.

Wrapping Up,

While there are several advantages of using blockchain technology and it has a significant contribution in the financial and economical sector, you must do your own research before opting for the same. As mentioned above, there are different types of blockchains that work differently and based on your requirement, sector, and other factors you should make a decision.

Are you searching for a professional product development solution? Third Rock Techkno’s competitive product development services and solutions can be exactly what your requirements are. Our professional team of developers provide a complete service for any type of development - web to app. Take a look at our portfolio and get in touch with us to start today!